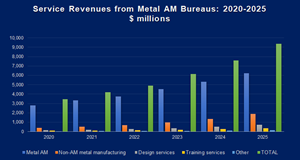

SmarTech’s New Report Projects US $9.4 Billion in Metal Service Bureau Revenues by 2025

27 January 2020

CROZET, Va., Jan. 27, 2020 (GLOBE NEWSWIRE) -- SmarTech Analysis has just issued its latest report on metal additive manufacturing service bureaus titled, “The Market for Metal Additive Manufacturing Services: 2020-2029”. In this new report, SmarTech Analysis has pegged revenues for Metal AM Services at $9.4 Billion by the year 2025. These projections include revenues from core manufacturing and prototyping services as well as from a slew of new value-added services. These new business offerings include design services, training and non-AM manufacturing such CNC and metal injection molding (MIM). SmarTech Analysis believes that these new services are where much of the growth for metal AM service bureaus will be found in the next few years and envisions today’s metal service bureau as being rebranded as “full-service metal shops for the age of Industry 4.0.” Additional details of the study including a TOC and excerpt are available at https://www.smartechanalysis.com/reports/the-market-for-metal-additive-manufacturing-services-2020-2029/ About the Report This report is the follow-on to our 2019 analysis and forecast on the opportunities for metal AM service bureaus. It updates SmarTech’s analysis and market projections and also extends the coverage to include a broader range of services and profiles of leading AM metal service firms. These new bureau services that we discuss are designed not only to provide new revenue streams but also offer points of differentiation in the metal manufacturing marketplace. In addition to the updated projections of the core manufacturing services that were projected in our 2019 report, this new report also provides ten-year forecasts of the value-added services listed above. In addition, we are including a new end-user industry – consumer products – in our analysis of metal AM service customers as well as adding five new service provider company profiles to the report. The report also assesses the impact on the service bureau business of the dramatic shift of AM to become a fully-fledged industrial manufacturing process. From the Report About SmarTech Analysis: For more details on our company go to www.smartechpublishing.com Contact: Robert Nolan A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/62abd676-b560-4ba1-bac7-92de2aee6294

This subject and many others will be addressed at the upcoming Additive Manufacturing Strategies 2020 event taking place in Boston, MA on February 11 and 12, 2020 at the Seaport Hotel. Speakers from over 60 companies will be discussing metal additive manufacturing and 3D printing in medical and dental. The event is being provided by SmarTech Analysis and 3DPrint.com. See www.additivemanufacturingstrategies.com for more details.

Companies mentioned include: 3D Systems, BeamIT, Burloak Technologies, Carpenter, DM3D, ExOne, FIT, GE Additive, Henkel, Hoganas, HP, i3DMFG, Metal Point Advanced Manufacturing, Materialise, MTI, Oerlikon, Protolabs, Renishaw, Sculpteo, Shining3D, Sintavia, Siemens, Solid Concepts, Stratasys, Thyssenkrupp, voestalpine, Wipro 3D3D Hubs, Hitch3DPrint and Xometry.

Since 2013, SmarTech Publishing has published reports on all the important revenue opportunities in the 3D printing/additive manufacturing sector and is considered the leading industry analyst firm providing coverage of this sector. SmarTech analysis and data drives strategy development in the additive industry and has been adopted and presented by many of the industry’s largest firms.

CMO/CBDO

SmarTech Publishing

(804) 938-0030

rob@smartechpublishing.comThe Market for Metal Additive Manufacturing Services: 2020-2029

Service Revenues from Metal AM Bureaus: 2020 - 2025 $ Millions